Many beginners ask about investing in the stock market. This simple guide breaks down the basics to help you start making informed decisions about buying shares.

Direct stock market investments are often beneficial for long-term goals like retirement. Buying shares means becoming a partial owner of a company, sharing in its success and profits. You can also invest in groups of shares through mutual or common funds. Once you understand them, investing directly in stock options is another option to consider.

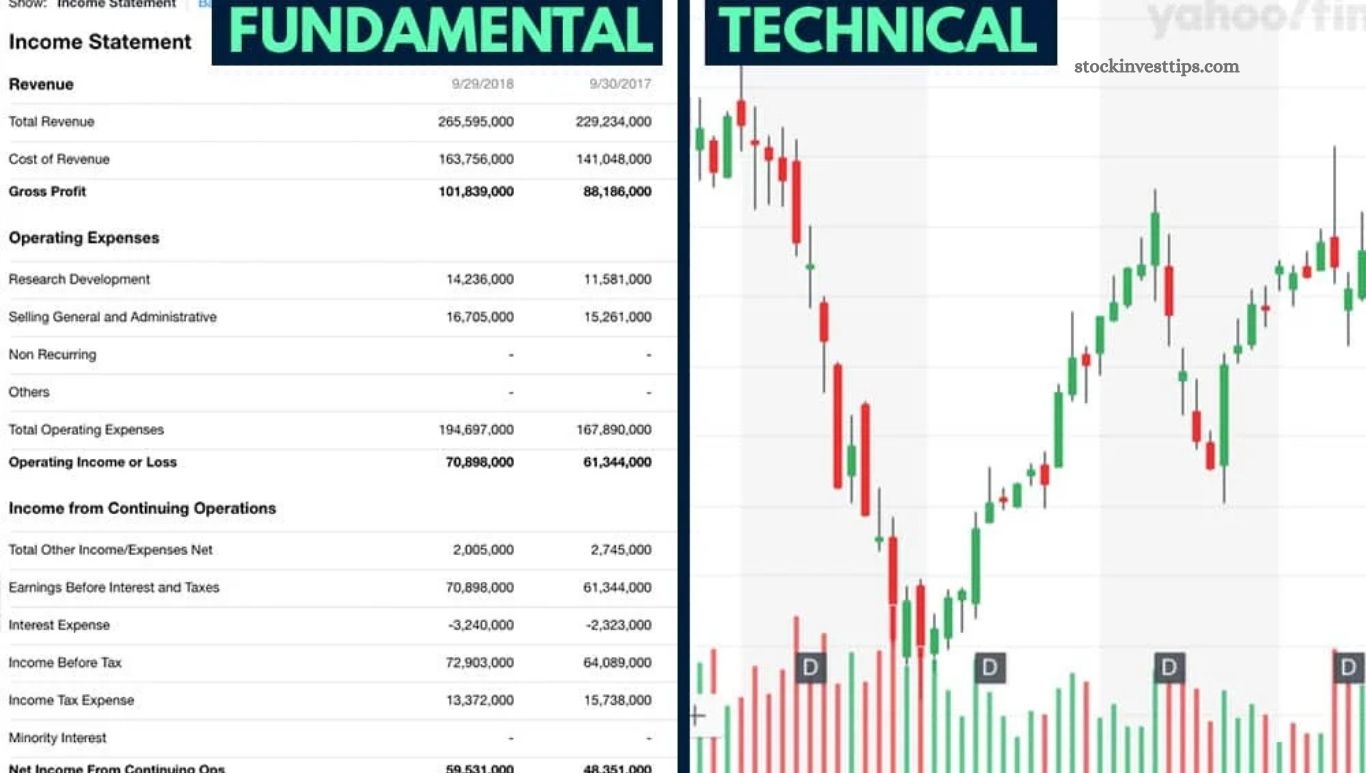

Technical analysis and fundamental analysis to purchase of share

Two primary methods analyze stocks: technical and fundamental analysis. Technical analysis forecasts future prices by examining past price trends. In contrast, fundamental analysis evaluates a company’s value by reviewing income, expenses, and growth potential.

Read More: How to Identify a Profitable Market Niche

How do you know if an action is good or bad to consider your purchase of share?

Key features to review when analyzing stocks include:

Price: The current price is crucial as it determines how many shares you can buy with your investment. Compare the current price to historical prices to decide if it’s a good deal.

Revenue Growth: Stock value rises when the company grows. Analyze income trends over time—consistent year-over-year or quarterly growth signals strength. If income is flat or declining, investigate the reasons.

Earnings Per Share (EPS): EPS measures profit per share and is often debated. While some sectors, like technology, may have negative EPS due to early-stage investments, generally, higher EPS indicates greater company value and stronger stock.

The Dividends

Many companies pay dividends, sharing a portion of their earnings with investors. If you seek dividend income, focus on the dividend rate and its percentage per share. Earnings not paid out as dividends are usually reinvested in the company.

When investing for dividends, track whether the dividend rate is rising, falling, or stable. For detailed analysis, Dividends.com is a valuable resource.

Keep in mind, not all strong companies pay dividends; many reinvest profits to grow. Lack of dividends shouldn’t deter you from investing unless your goal is regular dividend income.

Market capitalization

Market capitalization represents the total value of all publicly traded shares. Large-cap companies like Coca-Cola, Disney, and Walmart typically carry lower risk but offer slower growth since they are well-established. Many of these mature companies also provide regular dividend payments.

Analysis of the experts

Reading expert reports is valuable, but keep in mind that opinions often vary. To make a well-informed decision, review multiple reports before buying shares. Your stock exchange platform usually offers access to these diverse perspectives.

The industry

Analyzing the industry is as important as studying the company itself. Some industries face decline or environmental challenges, limiting growth and profitability, which affects the future value of shares.

These factors form the basis of fundamental analysis. For short-term investments, consider expert technical analysis as well. While the stock market offers no guarantees, educating yourself improves your chances of making smart share purchases.

Frequently Asked Questions

What are the main methods to analyze stocks before buying?

The two primary methods are fundamental analysis, which examines a company’s financial health and growth potential, and technical analysis, which studies past price movements to predict future trends.

Why is fundamental analysis important when buying shares?

Fundamental analysis helps evaluate a company’s true value by reviewing income, expenses, revenue growth, and market position, guiding long-term investment decisions.

How does technical analysis help in stock trading?

Technical analysis uses historical price data and chart patterns to forecast future price movements, often aiding short-term trading decisions.

What key financial metrics should I check before purchasing a stock?

Focus on current stock price, revenue growth, earnings per share (EPS), dividend rate, and market capitalization.

Should I consider dividends when buying shares?

Yes, if you seek regular income, check the dividend rate and its consistency over time. However, some profitable companies may not pay dividends as they reinvest earnings for growth.

How does market capitalization affect investment risk and growth?

Large-cap companies tend to be less risky but offer slower growth, while smaller companies may have higher growth potential with increased risk.

Why is it important to review expert stock reports?

Expert reports provide valuable insights, but opinions may differ. Reading multiple reports helps form a balanced view before investing.

How does the industry impact stock value?

Industry trends and challenges affect a company’s growth and profitability, influencing the future value of its shares.

Can I rely solely on analysis to guarantee profits?

No investment is guaranteed, but thorough analysis and education improve your chances of making informed, successful share purchases.

Conclusion

Analyzing shares before investing is crucial for making informed decisions in the stock market. By combining fundamental analysis—examining a company’s financial health and industry outlook—with technical analysis of price trends, you can better assess potential risks and rewards.

Understanding key factors like stock price, revenue growth, earnings per share, dividends, and market capitalization helps build a solid investment strategy. While no method guarantees success, continuous learning and careful research increase your chances of profitable share purchases over time.