Walmart Share, one of the largest discount retailers in the U.S., trades its shares on the New York Stock Exchange under the symbol WMT. The company currently pays about \$2.00 in annual dividends per share. Like all stocks, Walmart’s share price can fluctuate with the market.

Before investing, small investors should research thoroughly using trusted sources like Yahoo Finance, CNN, and Bloomberg to stay informed about stock performance and market trends.

What you should know when participating in the stock exchange

Diversify your investments by spreading your capital across different asset types. Avoid putting all your money into one financial product. Maintain a mix of bank accounts, certificates of deposit, and various stocks to reduce risk.

Investment risks include the chance of losing part or all of your capital, as stock values can rise or fall by 20% or more. Only invest money you can afford to lose. Choose between growth stocks, which offer high rewards but greater volatility, or stable companies with slower, steadier returns.

Read More: How to Start a Cosmetics Store

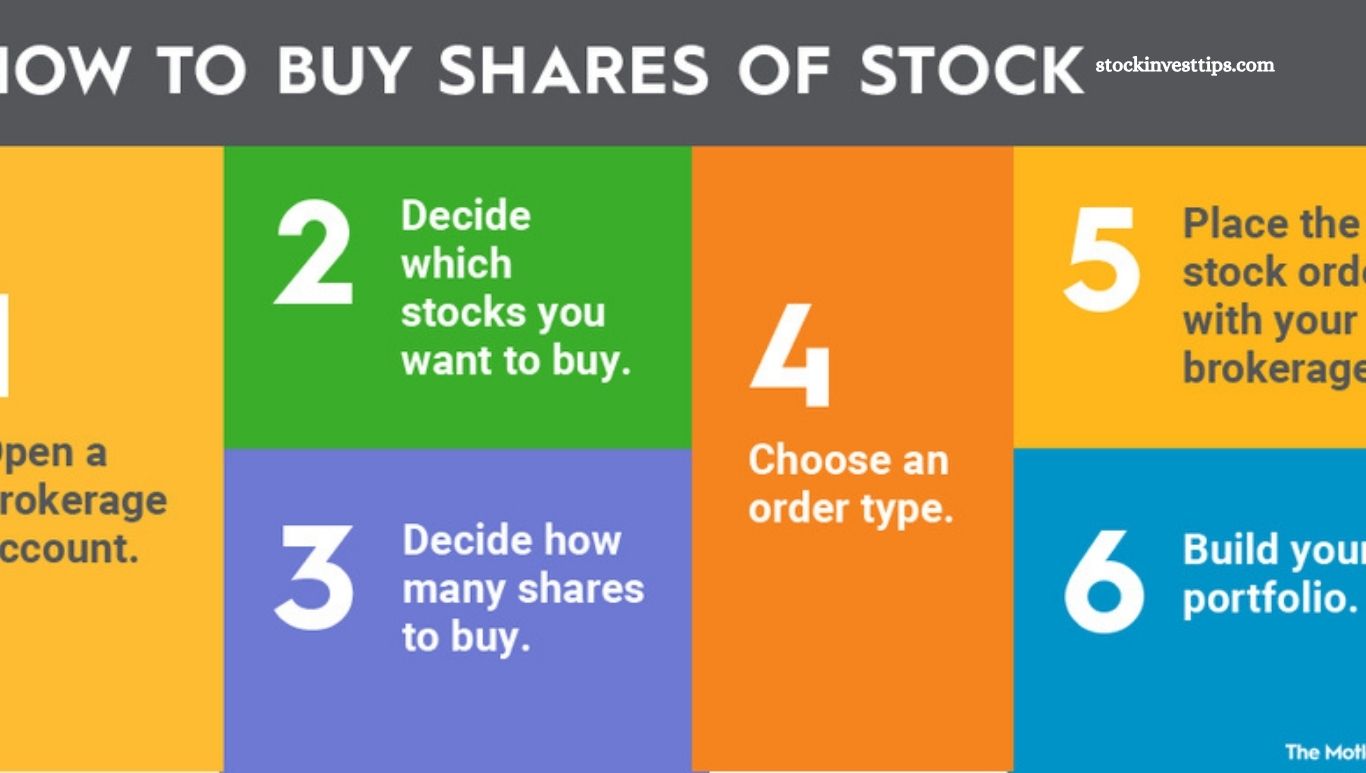

How to buy Walmart shares for small investors

Invest in Walmart through its direct investment plan via Computershare, Walmart’s agent for small investors. This plan lets you start with as little as \$50, providing easy access to a stable, well-established company. Open an account with Computershare to learn more and begin investing.

Alternatively, buy Walmart shares through a brokerage account. Broker-dealers like Ameritrade, Scottrade, ING, and Merrill Lynch Edge offer affordable fees—typically \$7 to \$20 per trade—for small investors. Transactions can be completed online or with the help of customer service agents.

Other options to invest your money

Small investors have more options beyond direct stock purchases, including lower-risk, cost-effective alternatives designed to grow your money.

Mutual funds allow you to invest gradually, spreading your cost over time instead of investing a lump sum. Companies like Vanguard, T. Rowe Price, and Fidelity offer funds that diversify across sectors such as banking, healthcare, and technology.

Exchange-Traded Funds (ETFs) provide similar diversification but trade like regular stocks throughout the day, offering flexibility. ETFs also let you invest small amounts across multiple companies.

By investing consistently over time, small investors can build wealth, but it’s essential to understand and manage the risks involved.

Frequently Asked Questions

What is the minimum amount needed to buy Walmart shares?

You can start buying Walmart shares with as little as $50 through the direct investment plan offered by Computershare. Otherwise, brokerages may require the price of at least one share plus transaction fees.

Where can I buy Walmart shares?

Walmart shares are available on the New York Stock Exchange (NYSE) under the ticker symbol WMT. You can buy them through brokerage accounts or directly via Computershare’s direct investment plan.

What are the fees involved in buying Walmart shares?

Brokerages typically charge between $7 and $20 per transaction. The direct investment plan through Computershare usually has lower fees, making it ideal for small investors.

Can I buy fractional shares of Walmart?

Some brokerages offer fractional shares, allowing you to buy a portion of a Walmart share. This makes investing more accessible if you have limited funds.

What are the risks of investing in Walmart shares?

Like all stocks, Walmart’s share price can fluctuate. You may gain or lose money depending on market conditions. It’s important to invest only what you can afford to lose.

Are there alternatives to buying Walmart shares directly?

Yes. Mutual funds and ETFs provide diversified exposure to Walmart along with other companies, reducing risk and allowing smaller, regular investments.

Conclusion

Investing in Walmart shares offers small investors a valuable opportunity to join a stable, well-known company with potential for growth and dividends. Whether through direct investment plans, brokerage accounts, or diversified options like mutual funds and ETFs, you can start with modest amounts and build your portfolio over time. Always research thoroughly and consider your risk tolerance before investing. Consistent, informed investments can help grow your wealth while managing market fluctuations.